What is the difference between CTC and Post Audit?

March 6, 2024

Exploring the Distinctions Between Continuous Transaction Control (CTC) and Post Audit

In the corporate landscape with a global footprint, professionals often encounter frameworks such as Continuous Transaction Control (CTC) and Post Audit, particularly if their organisations maintain branches across diverse jurisdictions. Both CTC and Post Audit represent models that tax authorities in various countries can deploy to govern electronic invoicing and transaction processing.

Within this blog, we delve into the intricacies of these two frameworks and their significance for enterprises operating within the ambit of one or more European or global departments. Additionally, we underscore how our assistance extends to companies navigating compliance requirements in nations embracing either CTC or Post Audit methodologies.

Continuous Transaction Control (CTC): A Real-Time Paradigm

At the core of Continuous Transaction Control (CTC) lies a suite of processes empowering local tax authorities to access financial data associated with business operations in real-time or near real-time. In contrast to traditional methodologies for tracking tax liabilities arising from transactions, CTC entails the direct transmission of data from business processes or data management systems to tax authorities, facilitating real-time or near real-time data acquisition.

Italy and Poland stand as early adopters of CTC, with France poised to commence implementation in 2025, making it obligatory from September 2026. In a CTC framework, TrueCommerce orchestrates the passage of your invoices through our solution, ensuring alignment with the stipulations of tax authorities. Subsequently, invoices undergo registration and validation processes before attaining approval from the authorities and being released to the end recipient.

Post-Audit: A Retrospective Evaluation

Conversely, the Post Audit model involves financial authorities abstaining from direct involvement in the exchange of invoices or other data between trading partners. Instead, they reserve the right to retrospectively verify adherence to prevailing requirements governing the invoicing process. In a Post-Audit model, TrueCommerce meticulously reviews invoice information to ensure compliance with relevant standards before application. The ensuing qualification of invoices with a signature is executed where mandated by the respective country.

Ultimately, qualified invoices are dispatched directly to the recipient. In cases where a Value-Added Network (VAN) provider plays a role, TrueCommerce channels the invoice through the VAN provider before its final dispatch to the recipient.

Distinguishing CTC from Post Audit: A Concise Summary

In essence, the dichotomy between these models manifests in the primary objective each serves. CTC is designed for the immediate registration and validation of invoices by authorities before dissemination to the recipient (buyer), almost in real-time. Conversely, Post Audit entails the direct dispatch of invoices to the recipient, with the seller subsequently reporting monthly VAT to the public administration. In a Post-Audit model, the necessity to seek prior approval from authorities for invoices, as mandated by CTC, is obviated.

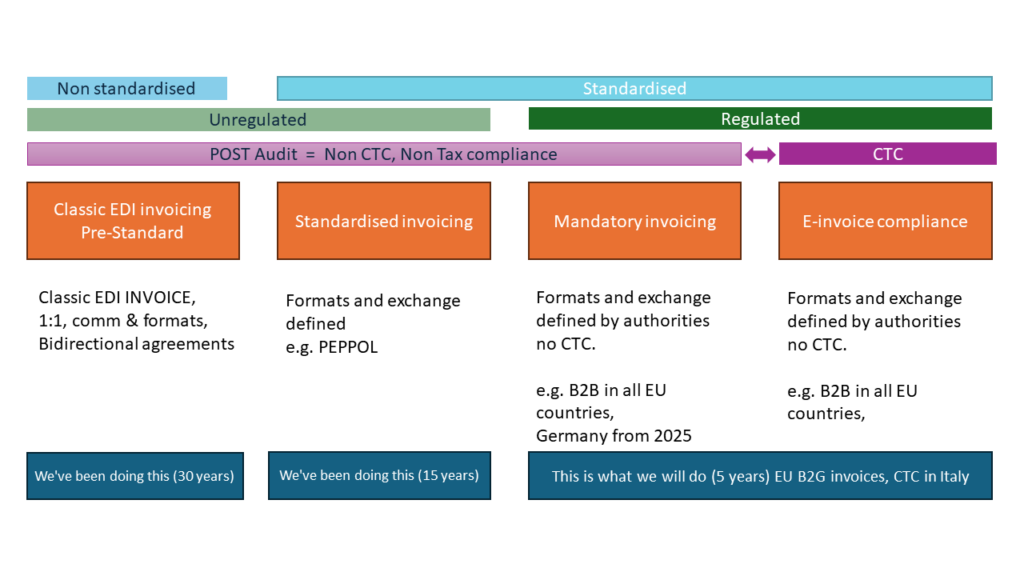

A visual representation encapsulating an overview of both models and the formats they employ is provided in the following diagram:

Navigating the Regulatory Landscape: How We Can Assist

The choice between a CTC or Post-Audit model is contingent upon the regulatory decisions of individual countries. Nations grappling with challenges associated with Value-Added Tax (VAT) fraud typically opt for CTC implementations, fostering a proactive stance in monitoring and controlling inter-company transactions within national borders. This approach bolsters transparency for authorities, facilitating the detection and prevention of VAT fraud.

For enterprises with a presence in one or more European or global jurisdictions, the task of staying abreast of specific regulations in each country is arduous. Given the resource-intensive and intricate nature of this endeavor, many organisations opt to engage a partner well-versed in this domain, outsourcing this nuanced aspect of their operations.

At TrueCommerce, we make sure that your business meets the various requirements, regardless of which model each country has chosen to implement.

Share this post:

Categories

Stay ahead of the competition

Get expert supply chain insights delivered directly to your inbox weekly.