Understanding Today’s Supply Chain Logistics

October 18, 2022

Between shipping delays, price hikes, and various goods shortages over the past few years, consumers have discovered that “supply chain” is more than just a buzzword. It’s the unsung hero of American business. Logistics professionals are responsible for navigating these disruptions and moving goods from factory to end consumer to ensure quality customer service in a continuously challenging market.

However, the headlines only skim the surface of what’s been going on in the transportation and logistics network. Inventory distribution has evolved, businesses are learning to balance efficiency with omnichannel flexibility, and technology has become central to end-to-end processes that maximize resources.

We sat down to discuss these logistics and supply chain management trends with a panel of industry experts, including John Lynch, Jeff Osmanson, and Jeff Pilof. They offered several key takeaways that should spark conversations for every industry.

The Evolution of Data Analytics in Logistics

For Jeff Osmanson, COO of Next Generation Technologies LLC, it’s not just using data but also how you use it. For decades data around supply chain performance was highly segmented and clunky in migrating from one step to another. The emergence of supply chain analytics software, AI, and electronic data interchange (EDI) has revolutionized data management in industries these technologies had not previously penetrated.

“We’ve seen a lot of progress in joining this data together,” Osmanson says, “so we can understand where the product is, what’s happening inbound, and then what happens inside the four walls of a retailer’s warehouse or fulfillment center.” Machine learning has made it possible to improve our understanding of raw data and truly optimize everything from distribution to inventory management to the fulfillment process. He believes optimization can save companies millions if they’re equipped to calculate and interpret data on a deeper level.

John Lynch, SVP for the American Trucking Associations, shared that trucking is one example of an industry late to the game in implementing and using data. He pins the turning point on the electronic logging device (ELD) mandate that went into place in 2018. This mandate required all services to be tracked via the ELDs and instantly progressed telematics from the realm of only the largest carriers to a uniform concern for companies across the board.

Transport and logistics businesses are finally far enough along in 2022 that ELDs are revealing minutiae about where companies are profitable and where their drivers are being held up. Lynch believes that “As a result, I think you’re seeing rates adjust because trucking companies have become more disciplined to say, I’m not going to take those lanes anymore.” In an industry where 89% of U.S. trucking companies operate just 1-5 trucks, this recent permeation of ELD usage and data analytics in logistics is positioned to be transformative.

The Job Market, Government Inaction & The Price of Logistics Today

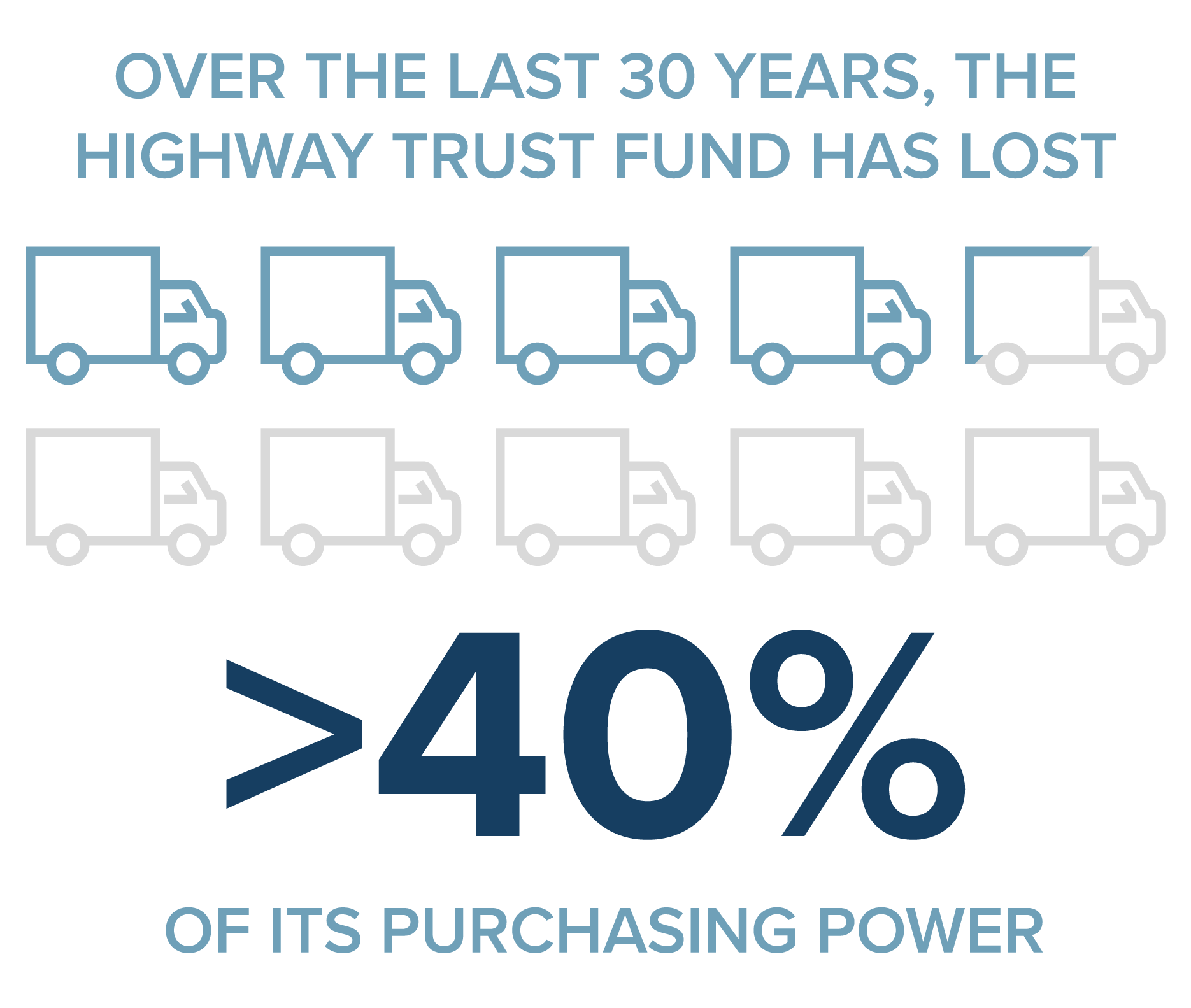

Lynch is alarmed at the lack of political will to fund infrastructure upgrades for the needs of modern logistics. Fuel taxes have not kept up with inflation, for instance. Tax hikes are politically unpopular, but “over the last 30 years, the highway trust fund has lost more than 40% of its purchasing power simply by way of inflation,” he laments. Lynch believes that congress’s inability to do something has set transport and logistics back substantially.

However, the government hasn’t been the only obstacle to efficiency or success. A challenging job market has profoundly impacted recent logistics trends, including the sourcing and storage of goods. Ports are heavily backlogged, shipments are delayed, and consumers are noticing. Jeff Pilof, Former SVP of Supply Chain for CVS Health, argues that it’s been due to a combination of forces such as:

- Recent increases in wages in less complex or work-intensive industries have drawn workers away from logistics and compounded existing labor shortages.

- Job burnout for the individuals who remain in logistics and work more overtime amid the shortage of workers.

- New competition between retail and logistics to fill full-time positions at the lower end of the wage scale.

Some solutions have been misguided. Many ports are now operating 24/7 to alleviate congestion, but this narrow measure has created other bottlenecks. Many warehouses are not open at the same hours. There are also situations where there exists a line of trucks waiting, but there are only three crane operators who can only move one container at a time.

”It may take an hour to get into the port, but four, five, or even eight hours to get loaded and get out of the port,” Lynch explains. “It’s not just a truck driver shortage. We have a modernization problem across the board.” Significant public and private investments in infrastructure throughout the supply chain are an urgent need.

The Lesson of Recent Logistics Trends

The pre-pandemic economy pushed for efficiency through leaner operations. Pandemic pressure has brought to bear the consequences of that strategy and shed light on long-simmering issues in the supply chain that “aren’t dramatically different than they were 10 or 20 years ago,” according to Pilof.

“I remember when I was first in the transportation space back in the late 90s, talking about the driver shortage, talking about the aging of drivers, talking about the increased cost of equipment,” he says. The difference today is that our infrastructure lacks the flexibility and slack to cope with these persistent problems in addition to the economic and supply chain disruptions across the globe.

The panel unanimously believes that agility is what the transport and logistics industry needs now. A more fluid capacity can adjust to disruptions and create efficiency through flexibility rather than narrow, lean specialization. The inability to get raw materials and other goods quickly has also re-energized the initiative to increase U.S.-based manufacturing.

Economic realities will always play a role in onshoring, but Piloff believes there will still be some regrowth in domestic manufacturing. “It makes a shorter supply chain. It creates middle-class jobs and health in the economy. Certainly there is more opportunity to be good stewards of policies around the future of the climate by having more manufacturing at home.”

The degree to which manufacturing returns to U.S. shores remains to be seen.

Interested in hearing more from our expert panel on today’s logistics trends? Watch the webinar on-demand for further insights into how businesses balance efficiency with flexibility and the impact these trends have on buyers and sellers.

About the Author: Ivy Davis is a Demand Generation Manager at TrueCommerce who has spent years delving into the challenges faced by manufacturers and retailers across industries. She focuses on providing supply chain insights and actionable advice through webinars, blogs and thought leadership interviews. She believes that empowering decision makers with knowledge drives them to make thoughtful decisions about supply chain technology and improve their overall business strategy. After a long day’s work, Ivy enjoys cooking with her two kids and gardening outside.

Share this post:

Stay ahead of the competition

Get expert supply chain insights delivered directly to your inbox weekly.