EDI 820

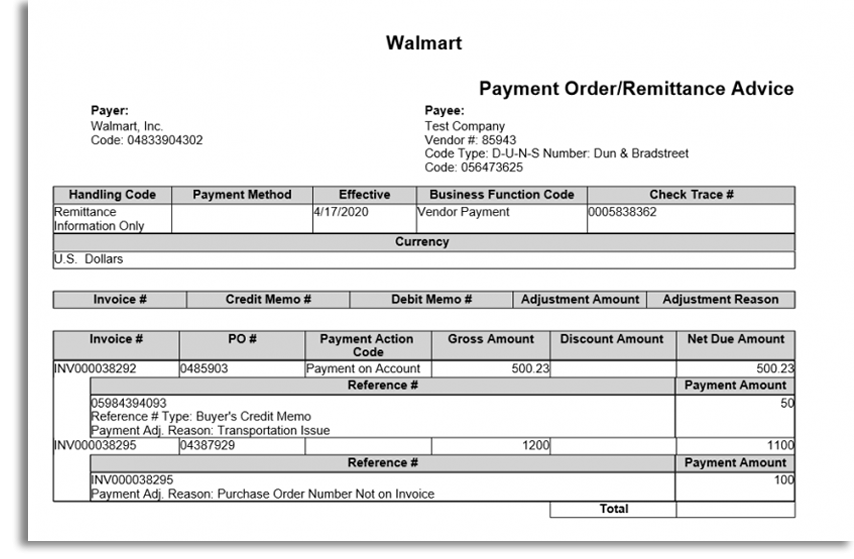

Payment Order or Remittance Advice Document

What is an EDI 820?

An EDI 820 is a type of EDI transaction, which is used to transfer payment data between buyers and sellers. EDI 820 is also known as a Payment Order or Remittance Advice document, normally sent in response to an EDI 810 Invoice or EDI 850 Purchase Order to confirm payment details and/or advise the seller of any adjustments to the payment amount. Usually, an EDI 820 is sent jointly with the payment itself via electronic funds transfer.

EDI 820 documents follow the x12 format set by the American National Standards Institute (ANSI), a not-for-profit organization that regulates EDI formats in the U.S.

What are the Essential Components of EDI 820?

An EDI 820 document must incorporate key elements pertaining to payment details. These include:

- Payer and payee identification, such as company names, addresses, and payer identification number

- Invoice or Purchase Order number

- Amount billed/to be paid, may include adjustments and tax information

- Applicable banking information for both the payer and payee

- Payment tracking information

How Do I Use EDI 820?

EDI 820 documents are sent from the buyer to the seller and act as a statement of intent to pay. After being sent to the accounts receivable department via EDI integration with your ERP, the EDI 820 is matched up with its counterpart EDI 810 or another invoice format. From there, your EDI solution, ERP or accounting staff can settle the open account.

Generally, EDI 820 documents are used in conjunction with a payment to confirm payment details to the seller. However, an EDI 820 document can also be used to advise the seller of important adjustments to the invoice, which may change the total payment amount, and to provide instructions for payment to the associated bank. It can also provide information on previous payments to the same invoice.

While an EDI 820 can be triggered automatically by the receipt of an EDI 810 or 850, buyers can also choose to send an EDI 820 document in response to an invoice of any format. Additionally, the seller’s bank might also issue an EDI 820 to the seller upon receipt of payment.

After an EDI 820 is received by the seller, the seller’s EDI solution generates an EDI 997 Functional Acknowledgement, which is sent back to the buyer to confirm receipt. Assuming funds have been properly transferred, this marks the end of the order cycle.

What are the Benefits of EDI 820?

When translated, the EDI 820 document includes the same information as a paper Payment Order or Remittance Advice. However, the data encryption used for electronic data interchange keeps buyer, seller and payment information much safer than sending these notices by fax, email or PDF.

By automating EDI 820 sending and receipt, both buyers and sellers can streamline their order process. For sellers specifically, this automation enables management by exception, whereby accounting teams only need to address open accounts when alerted to an issue, rather than having to track all accounts, re-type data or issue functional acknowledgments manually for each order.

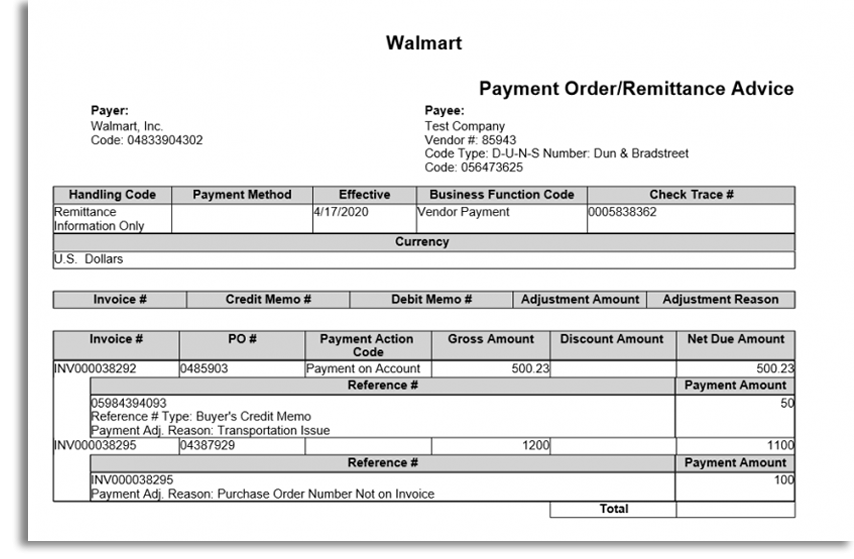

EDI 820 Format Example

EDI 820 can be viewed in two formats – a human “readable” version and a “raw” data version. The example below shows the raw EDI data, which is then translated by your EDI solution, sent to your business system (ERP) and used for reconciliation by your accounts receivable/payable department.

- Click to See Example

-

ISA*00* *00* *08*925485US00 *12*9622309900 *200415* *U*00501* *0*T*>

GS*RA*925485US00*9622309900*20200415*1407**X*005010

ST*820

BPR*I***************20200417*VEN

TRN*3*0005838362

CUR*PR*USD

N1*PR*Walmart, Inc.*UL*04833904302

N1*PE*Test Company*1*056473625

REF*IA*85943

ENT*1

RMR*IV*INV000038292*PO*500.23*500.23

REF*PO*0485903

REF*DP*001

DTM*097*20200408

ADX*50*TI*CM*05984394093

ENT*2

RMR*IV*INV000038295**1100*1200

REF*PO*04387929

REF*DP*002

DTM*097*20200410

ADX*100*MH**INV000038295

SE*20

GE*1

IEA*1*